How much do banks lend for mortgages

Youll want to really hone those figures down to a fine point because lenders. The secondary market also helps support a stronger more resilient primary housing market on.

Pin On Finance Infographics

So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

. For example a mortgage lender may raise 10 million in loans. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. How much home loan can bank give.

Im curious how much of a loan we can expect based on her income alone. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Purchase or Refinance Owner-Occupied Commercial Real Estate Save as a Union Bank Client.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. Im planning on finishing the building of the home from around 50-60 on by myself. The first step in buying a house is determining your budget.

1 day agoHeres where we currently stand. This frees up another 300000 to 30 million for Lender A to sell more mortgages. DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial.

The pool is then sold to a federal government agency such as Ginnie Mae or a government-sponsored company GSE such as. A general rule is that these items should not exceed 28 of the borrowers gross. Bank Has Loan Officers To Personally Guide You Through the Home Mortgage Process.

Our How much can I borrow calculator depends on an accurate input of your income and recurring debt. Lenders placing caps on borrowing. This mortgage calculator will show how much you can afford.

Four components make up the mortgage payment which are. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Have One of Our Bankers Call You Today.

Rural 1st offers a deep understanding of rural. Were not including additional liabilities in estimating the income. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating.

In most cases a bank will only lend up to 85 percent of the propertys worth as a loan against the value of the propertyIf you desire a house. Because lenders use their funds when extending mortgages they typically charge an origination fee of 05 to 1 of the loan value which is due with mortgage payments. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. At the time of this writing in late August the average 30-year mortgage rate was 588 percent up from 557 percent a month ago versus 508. Ad Available Only for Union Bank Clients.

Bank Has Loan Officers To Personally Guide You Through the Home Mortgage Process. So if you pay 1000 a month in interest and they pay 750 a month intrest then they make 250 a month profit. Bank of America said it is now offering first-time homebuyers in a select group of cities zero down payment zero closing cost.

31 2022 955 AM PDT. Fill in the entry fields and click on the View Report button to see a. Medium Credit the lesser of.

Interest principal insurance and taxes. 14 Assuming a 20 down payment you would need 80940 for a down payment plus several. We Offer Competitive RatesFees Online Conveniences - Start Today.

Youd have to define what you mean by profit. We Offer Competitive RatesFees Online Conveniences - Start Today. When you apply for a mortgage how much youll be able to borrow is usually capped at a multiple of your annual earnings.

As of October 2021 the median home price in the US. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

The Dos And Don Ts Of Buying A Home Infographic From Amerifirst Home Mortgage What To Do And Not Do Dur Home Buying Process Home Mortgage Buying First Home

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

Comparing Rocket Mortgage Vs Local Bank For A Mortgage

Interesting Points Even If It Is Canadian Data Very Similar Figures For Australian Consume Refinance Mortgage Mortgage Amortization Calculator Mortgage Tips

Retail Banks Still Profit From Mortgage Lending Home Loans For All Banks Building Retail Banking Mortgage

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

Bank Of America Mortgage Lender Review Nextadvisor With Time

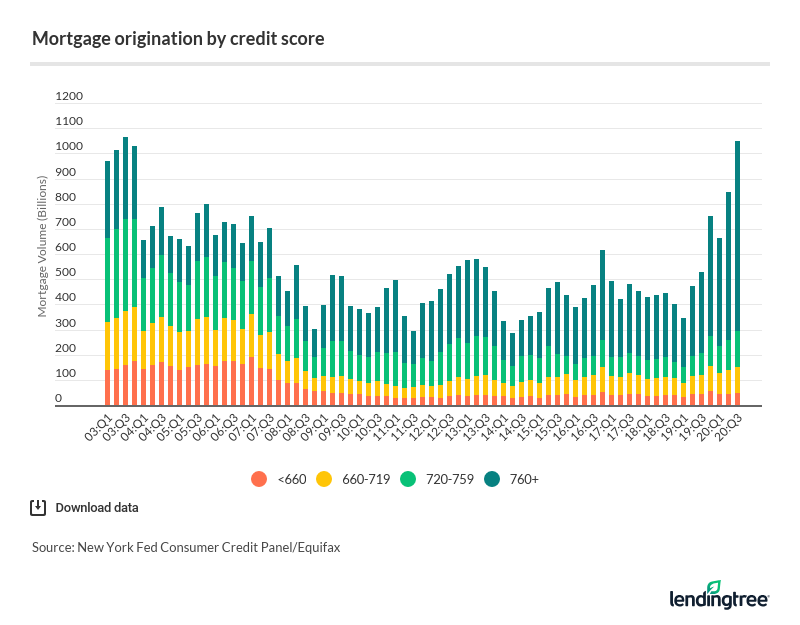

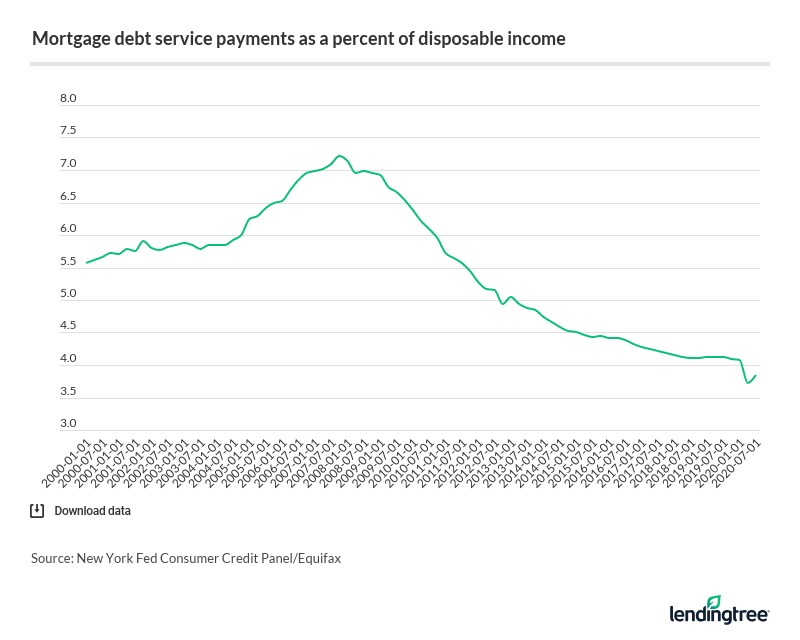

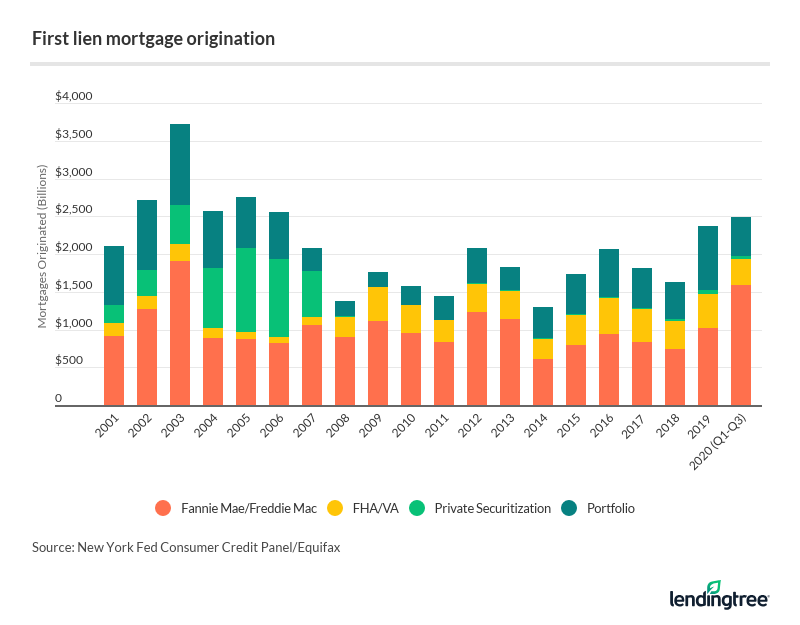

U S Mortgage Market Statistics 2020

Learn Everything You Need To Know About Mortgages

Clopton Capital Is Secondary Market Commercial Lender That Offers Commercial Real Estate Loans For Commercial Insurance Commercial Property Commercial

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

U S Mortgage Market Statistics 2020

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

U S Mortgage Market Statistics 2020

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Real Estate Tips