Intuit payroll tax calculator

Exempt means the employee does not receive overtime pay. Use our child tax credit calculator to determine your eligibility for tax year 2020 or tax year 2021.

Quickbooks Paycheck Calculator Intuit Paycheck Calculator

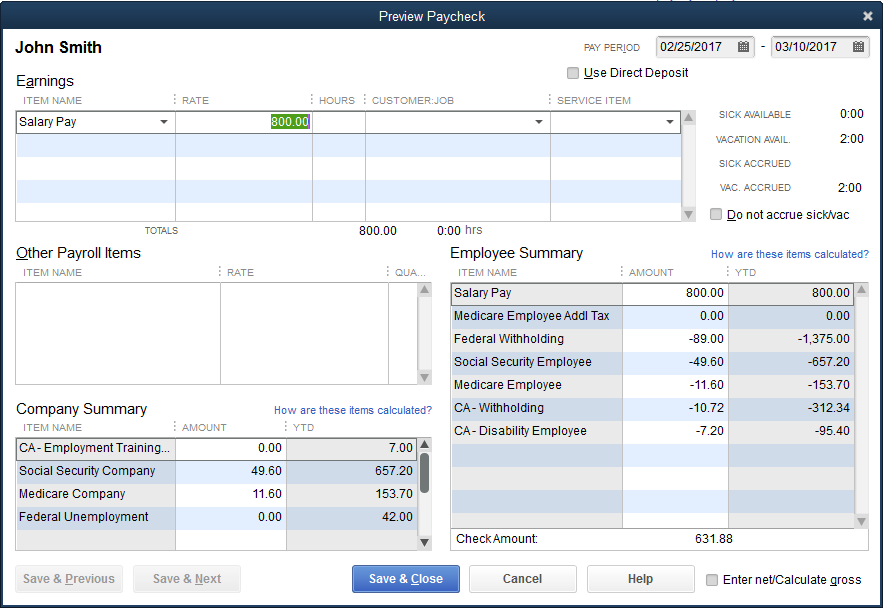

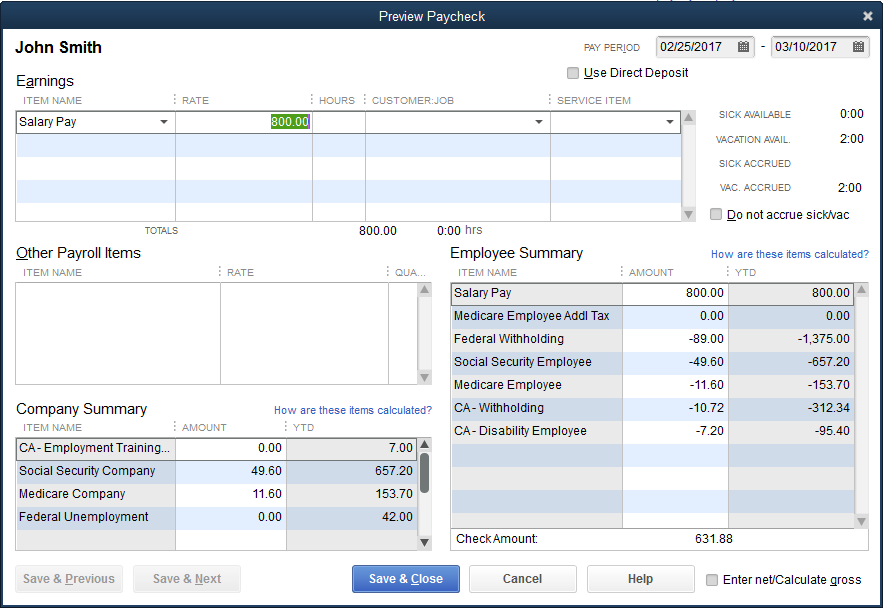

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

. Try asking your employer specifically their payroll human resources or accounting department. Length of residency and 7. Check out our updated bonus calculator that answers one of our most frequently asked questions and get an estimate of how much federal taxes will be withheld from your bonuses when you receive them.

Performance may slow when processing payroll for more than 100 employees. Tax Advice Expert Review and TurboTax Live. Under tax reform the federal tax rate for withholding on a bonus was lowered to 22 down from the federal income tax rate of 25.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. Create automatic tax plans for individual clients using tax return data mined from your Lacerte or ProConnect Tax software. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

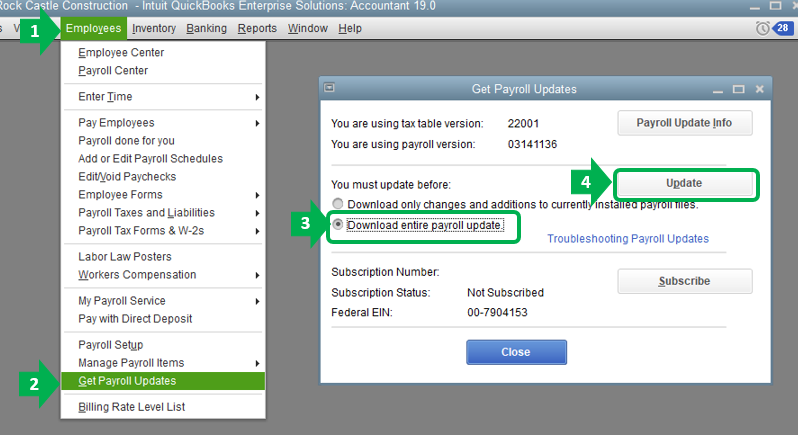

Sales 877 202-0537 Mon-Fri 6 AM to 6 PM Pacific Time Support We provide multiple support options so you can get assistance when you need it. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022. Active subscription Internet access and Federal Employer Identification Number FEIN required.

Intuit QuickBooks Basic Payroll Standard Payroll Enhanced Payroll and Enhanced Payroll for Accountants. Intuit QuickBooks Payroll Basic. Intuit will assign you a tax expert based on availability.

This is assuming your employer kept the same EIN most of them do. Go here to get support for Basic Standard and Enhanced Payroll. Support available Monday-Friday 6 am- 6 pm PST.

Get it from last years W-2 if youre still working for the same company. 247 access requires Internet and is subject to occasional downtime. Then enter the employees gross salary amount.

Gain a proven solution for write-up AP AR payroll bank reconciliation asset depreciation and financial reporting. You andor your child must pass all seven to claim this tax credit.

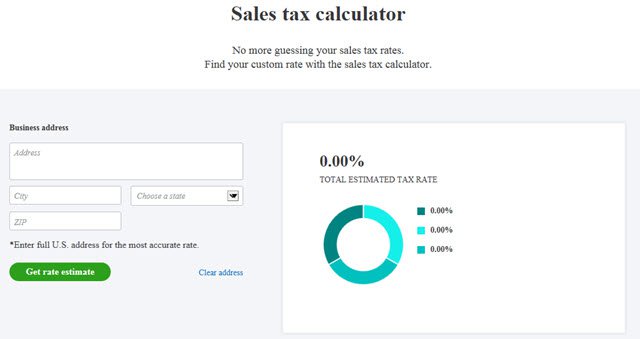

Quickbooks Launches Sales Tax Calculator Site Insightfulaccountant Com

One Day Processing Now Available For Quickbooks Payroll

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Federal Withholding Not Calculating

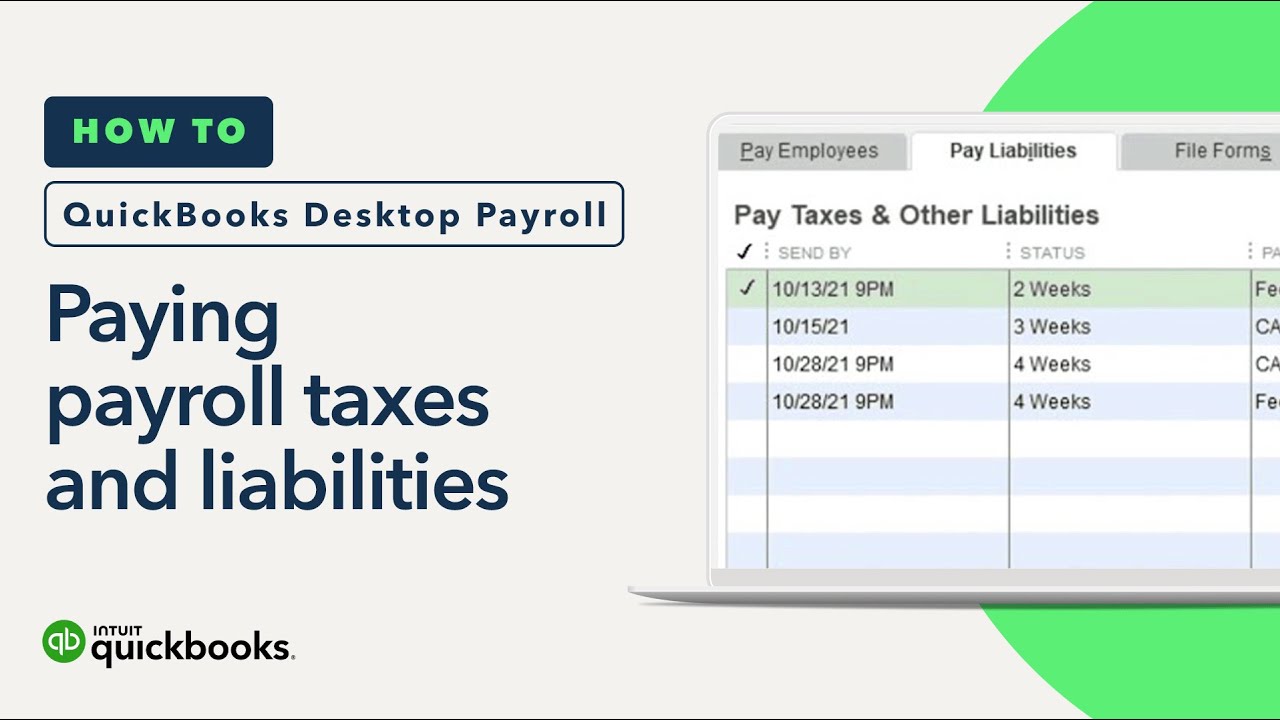

How To Pay Payroll Taxes And Liabilities In Quickbooks Desktop Payroll Youtube

Federal Withholding Not Calculating

Solved Federal Taxes Not Deducted Correctly

Free Step By Step Instructions To Run Payroll Tax Calculator 2021

Quickbooks Desktop Calculates Wages And Or Payroll Taxes Incorrectly

Calculate Your Paycheck In Seconds Article

Quickbooks Elite Payroll Full Service Payroll With Added Features

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

Federal Tax Withholding

Using Quickbooks Online To Calculate Estimated Qtrly Tax Payments Youtube

Federal Tax Withholding

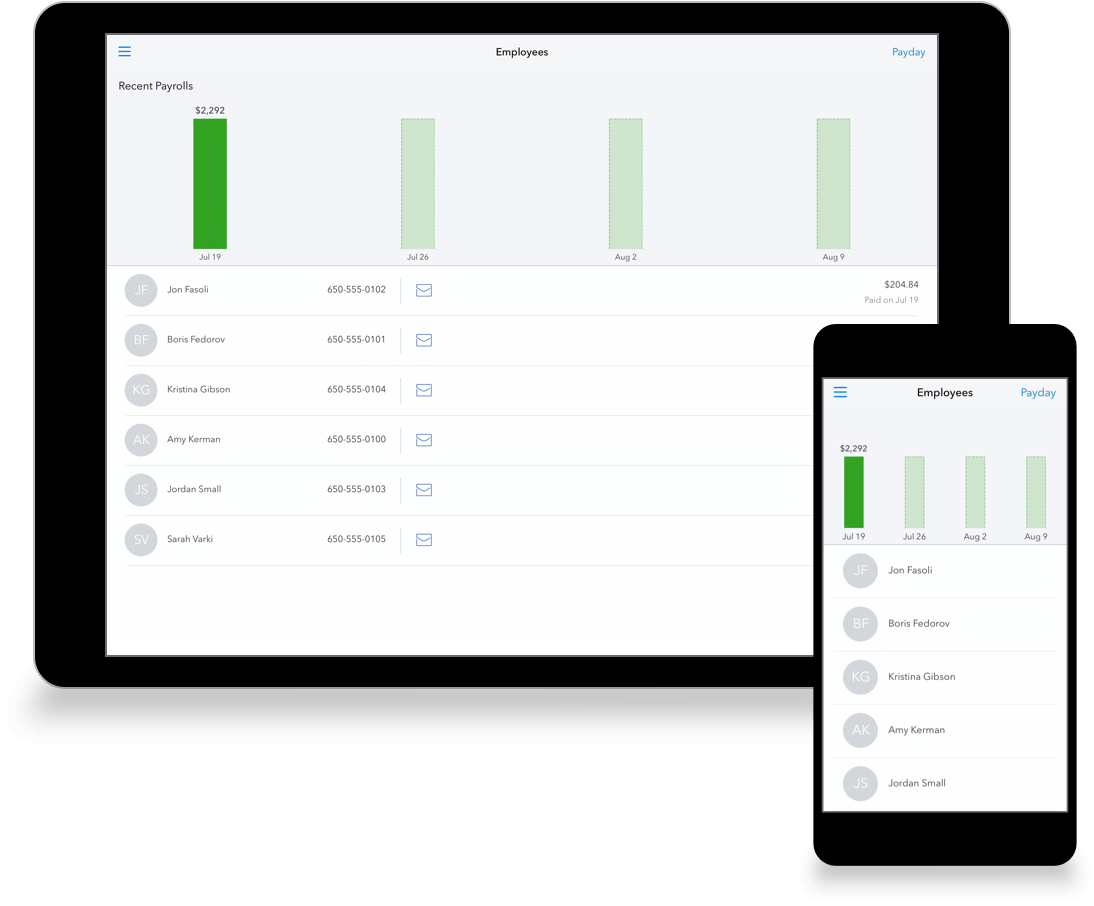

Payroll App For Small Business Run Payroll From Mobile With Quickbooks

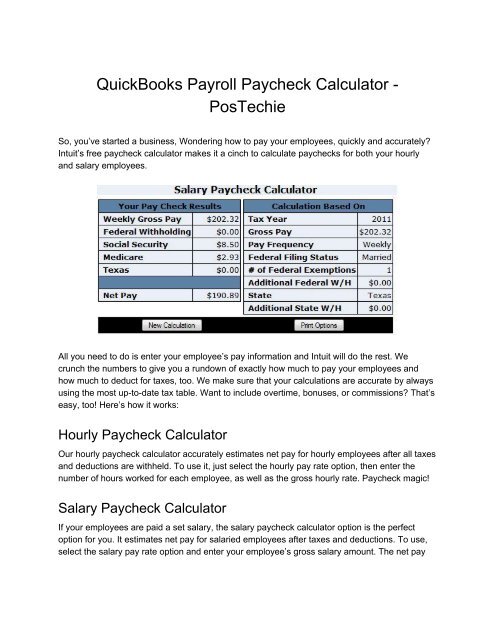

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks